Abstract

The distribution of ownership of transition risk associated with stranded fossil-fuel assets remains poorly understood. We calculate that global stranded assets as present value of future lost profits in the upstream oil and gas sector exceed US$1 trillion under plausible changes in expectations about the effects of climate policy. We trace the equity risk ownership from 43,439 oil and gas production assets through a global equity network of 1.8 million companies to their ultimate owners. Most of the market risk falls on private investors, overwhelmingly in OECD countries, including substantial exposure through pension funds and financial markets. The ownership distribution reveals an international net transfer of more than 15% of global stranded asset risk to OECD-based investors. Rich country stakeholders therefore have a major stake in how the transition in oil and gas production is managed, as ongoing supporters of the fossil-fuel economy and potentially exposed owners of stranded assets.

Similar content being viewed by others

Main

The transition to a global low-carbon economy entails deep and fast structural change that poses challenges for economic adjustment everywhere1,2. One key challenge both for the real economy and financial markets is the fast phase-out of fossil-fuel production, which will necessitate the write-down of major, functioning capital assets and reserves reflected as assets on fossil energy companies’ balance sheets. But while over 100 studies have analysed scenario-contingent early retirement of fossil-energy supply facilities3, this retirement has not been linked to financial ownership. As a result, academic and regulator studies undertaking stress tests of the financial system start from synthetic shocks to financial assets, rather than the underlying real assets4,5,6. The distribution of financial ownership and exposure to loss risk remains insufficiently understood.

Asset stranding is the process of collapsing expectations of future profits from invested capital (the asset) as a result of disruptive policy and/or technological change7,8. This loss of value in fossil-fuel assets is reflected in investor expectations of enterprise value and therefore market prices, including—where listed—stock market indices. Such price corrections lead to a wealth loss for the ultimate owners of these assets; additionally, further losses can propagate to other entities indirectly through highly connected financial networks.

Asset stranding becomes a social concern where these effects destabilize financial markets with negative repercussions in the real economy such as on pensions and government finances9,10. The (premature) obsolescence of capital stock is a recurring feature of dynamic, capitalist economies, as new products and industries replace old ‘sunset’ ones, and is not typically associated with systemic financial risks because the financial sector is buoyed by the new ‘sunrise’ sectors2. Yet, in the case of the low-carbon transition, the rate of industrial change required for achieving a 2 °C, let alone 1.5 °C, goal is so large11 that the rapid collapse of fossil-fuel ‘sunset’ industries presents major transition risks6,12.

Here we map comprehensively the current global financial geography of stranded oil and gas asset risk for equity ownership. We trace potential losses from extraction sites through corporate headquarters and their immediate shareholders (including banks and fund managers) all the way to the ultimate owners (government and individual shareholders) for oil and gas extraction companies worldwide. We comprehensively link fossil-fuel stranded assets and transition risk studies at the asset level for the transmission channel of equity mispricing. We distinguish both geographic and functional characteristics of the organizations along the equity ownership path. We find that exposure to wealth losses is more evenly shared geographically than the distribution of oil and gas production assets may suggest. Therefore, private investors in rich countries have both a larger stake in continued fossil-fuel production and greater exposure to stranded assets than the literature has so far suggested.

Estimating stranded assets and wealth losses

We operationalize asset stranding as the effect of a change in expectations on the present value of discounted future profit streams. We calculate profits given expectations per asset. Energy is supplied from 43,439 oil and gas production assets based on Rystad’s Ucube dataset. Whether an asset is expected to supply demand depends on its present-day production cost and reserve profile in relation to the expected market-clearing oil price. If investor expectations for total demand for oil and gas fall, some assets must become unprofitable relative to initial expectations; that is, the oil or gas price falls below the break-even price for those assets.

Once the stranded assets are determined, we establish a four-stage description of who bears the loss. At stage 1, asset stranding is attributed to the country where sites are located. Stage 2 aggregates the ownership of stranded assets by fossil-fuel company. Each asset is owned by one or more oil companies (we count 69,990 ownership links). The loss is allocated to the country where the parent company has its headquarters. Out of the 3,113 active oil and gas parent companies reported in the Rystad database, our analysis identifies 1,759 as owning 93.4% of all losses. The 1,772,899 company nodes in the global equity ownership network are curated from Bureau van Dijk’s ORBIS database. At stage 3, this allows us to further trace the financial losses through the directed graph of ownership using a network model. Losses pass through 33,836 separate corporate ownership and fund management nodes, including most of the world’s large financial companies, to 16,171 ultimate corporate owners. At stage 4, we track all losses to their ultimate owners, governments and individuals, as shareholders or outright owners of companies or investors in funds, including pension funds. To account for company-level losses, we subtract losses from shareholder equity on the balance sheet reported in ORBIS in the most recent year (typically 2019). We detail our stranding and loss propagation models in Methods.

To quantify profit losses from changing expectations, we use an initially expected (baseline) scenario of global oil and gas demand and prices, upon which prior financial value has been estimated, and a revised scenario representing updated expectations resulting from climate policies (policy scenario). We call the expectations shift a realignment.

Our focus is on the medium realignment, in which the baseline scenario follows IEA’s WEO 2019 current policies scenario, consistent with 3.5 °C median warming in the 21st century. We refer to this baseline as investor expectations, InvE. The policy scenario, termed EUEA, incorporates the stated policies of the European Union (EU) and East Asia (EA) to reach net-zero greenhouse gas/CO2 emissions by 2050/2060, respectively, noting that non-CO2 emissions are exogenous and follow RCP2.6 (Methods). The EUEA scenario has a median warming of 2 °C. In line with the IEA’s projections1, the policy scenario features sell-off (SO) behaviour, whereby companies operating at low-cost fields in the Middle East supply a larger and increasing share of the market as the global oil and gas demand peaks and declines and low-cost producers scramble to capture the declining market.

We assume expectations to realign in 2022. Because the expectations underlying current asset prices vary, evolve continuously and are extremely difficult to quantify, we consider three other possible realignments, each yielding a magnitude and distribution of risk ownership.

Oil and gas demand and prices in baseline and policy scenarios are produced by the E3ME-FTT-GENIE integrated assessment modelling framework, which like CGE models provides sufficient sectoral disaggregation13,14, while remaining theoretically consistent with asset stranding. It couples a macroeconometric model of the economy that distinguishes 43 sectors and 61 regions and their trade (E3ME), an evolutionary energy technology model distinguishing 88 supply and demand-side technologies (FTT)15,16,17 and a carbon cycle and climate system model of intermediate complexity (GENIE)18. The embedded energy market model determines which assets supply demand (Methods). The overall model and alternative scenarios are presented in Supplementary Notes1 and 2.

We illustrate our calculation of total stranded assets in the medium realignment (Fig. 1a). Annual revenue in the InvE baseline grows, while in the EUEA policy scenario it reaches an early peak and falls steadily due to both lower quantities and prices. Upstream oil and gas lost profits, a subset of lost revenue after subtracting labour and intermediate input cost, is represented by the light green wedge. We discount differences in expected profits by 6% y−1 (Fig. 1b) to calculate the present value of stranded assets, which sums to US$1.4 trillion (see Supplementary Note 3 for a sensitivity analysis about the choice of discount rate). That is, investors realign their expectations of the ability of assets to generate profits from the baseline to the policy scenario in 2022 over a 15 yr horizon of profits, and present-value accounting translates deflated profit expectations into lower asset value.

a, Global revenue and profit trajectories over 2018–2036 according to the medium realignment’s initial and revised expectations. Green shades indicate reduction in revenue and profits under revised relative to initial expectations. b, Annual asset stranding as a result of medium realignment of expectations in 2022. The first year has negative stranded assets as sell-off behaviour generates windfall profits for low-cost producers.

Propagation of risk ownership

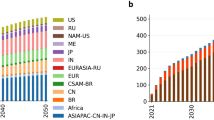

The ownership of the global US$1.4 trillion stranded assets propagates through the four stages across major geographic and institutional categories (Fig. 2). Geographically, losses are transferred to Organisation for Economic Co-operation and Development (OECD) countries. A total of US$552 billion, or 39.2%, of physical stranded assets sit in OECD countries (stage 1). Losses on balance sheets of OECD-headquartered oil and gas companies rise to US$728 billion or 51.7%, since these companies own or have a claim on profits from production assets across the globe (stage 2). The OECD share peaks at 57.1% for ultimate corporate owners at stage 3 due to financial investments of OECD-based companies in oil and gas companies elsewhere. Stage 4 redistributes 1.6% of losses back to non-OECD countries mainly via non-OECD clients of OECD-based asset managers.

Each bar represents $1.4 trillion in losses from medium expectations realignment at successive ownership stages, divided into OECD and non-OECD losses, and within each geography into major institutional categories.

Institutionally, most losses, US$1.0 trillion, are booked by stock-market-listed oil and gas companies. At stage 3, the financial sector owns losses of US$438 billion, 88% of which sit in OECD countries. At stage 4, governments directly own (including via pension funds) losses of US$484 billion (34%), most of which originate in non-OECD countries. Private persons thus own over half the losses. Losses exceed equity by a total of US$129 billion in 239 companies with a total debt of US$361 billion, leading to technical insolvencies. At stages 3 and 4, some uncertainty remains over the loss allocation due to data limitations (discussed in Supplementary Notes4 and 5).

Physical stranding (Fig. 3a) is largest in the United States and Russia (about US$300 billion each), followed by China and Canada (about US$100 billion each). Low-cost Middle Eastern producers (Qatar, Saudi Arabia, Iran) display comparatively modest losses of less than US$50 billion because their production sites remain profitable and they engage in sell-off behaviour. Several countries show different levels of exposure across stages, implying net exports of financial risk. For example, in stage 2 France imports nearly all of its losses, which are similar in magnitude to those incurred by Saudi Arabia at stage 1, while the United Kingdom increases its losses by a factor of nine, to a level comparable with China and Canada (Fig. 3b). Meanwhile, some countries such as Nigeria and Kazakhstan export more than half their losses to foreign companies, demonstrating that the location of physical assets is an unreliable indicator of the location of financial risk ownership.

a–d, Lost profits under medium realignment allocated to: the country where stranded oil and gas fields lie (stage 1) (a); fossil-fuel company headquarters country (stage 2) (b); ultimate corporate owners by country by sector (stage 3) (c); ultimate owners by country and institutional affiliation (stage 4) (d). Countries displayed in descending order of stage 4 losses. Markers indicate country loss totals at previous stages.

The largest net transfers at stage 3 are to the United States, where the world’s largest asset managers hold investments in virtually all listed oil and gas companies19 (Fig. 3c). Other smaller countries, such as the British Virgin Islands and Switzerland, viewed as tax havens20, also receive large transfers of losses. Stage 4 documents a redistribution of US- and UK-managed fund losses to clients around the world (Fig. 3d). Net trans-border redistribution shown from stage 3 to stage 4 is a lower bound as a notable portion of unknown ultimate owners of companies may be foreign investors, with limited information in the public domain (Supplementary Notes4 and 5). The distribution between government and individuals within countries depends mainly on the presence of state-owned companies.

The international net transfer to OECD-based entities of a sixth to a fifth of all losses between the physical stranded assets and the corporate owners’ balance sheet is robust across realignments and represents up to 60% of stage 1 OECD losses (Extended Data Fig. 1). Moreover, the ranking of countries’ losses at stage 4 is also robust to different realignments and network sensitivity checks as well as to the potential unavailability of carbon capture and storage and (Extended Data Figs. 2–8 and Supplementary Notes6–8). Our results are overall consistent with those of the Carbon Tracker Initiative for 14 major oil and gas companies (Supplementary Note 9 and Supplementary Fig. 1) and our oil and gas demand is in the range of that in other scenarios with similar warming potential including those used by the Network for Greening the Financial System21 (Supplementary Note 10 and Supplementary Figs. 2–5).

Risk of loss amplification in financial markets

Financial markets may amplify equity losses as they propagate through ownership networks. One amplification channel is via cascades of stock market losses. Any investor in the shares of a listed oil or gas company that is itself stock-market listed will amplify the shock from stranded assets as both companies’ stock market valuations are likely to suffer. In addition to US$1.03 trillion (73%) of total stranded assets owned by listed oil and gas headquarters at stage 2, a further total of US$70 billion affects balance sheets of listed corporate owners as the shock propagates through the chain (Fig. 4a). Funds from listed fund managers own US$165 billion in stranded assets. Overall, listed companies own US$1.27 trillion of stranded assets, of which 19% only become apparent in the ownership chain (Supplementary Note 11 discusses the potential impact of fund losses on fund managers).

a, Global losses affecting stock-market-listed fossil-fuel headquarters, intermediate and ultimate corporate owners, and listed fund managers in the medium realignment. b, Same as in a, but for all financial institutions. See c for legend. Creditors equal negative equity, reducing creditors’ collateral. c, Same as in b, but split by country. The y axis is compressed between US$0.10 and US$0.28 trillion.

Furthermore, any financial institution in the ownership chain—listed or not—amplifies the shock, since returns on financial assets justify these companies’ valuations. If losses at every financial institution along the ownership chain are summed, an upper bound of US$681 billion in potential losses could affect financial companies (Fig. 4b). Up to US$400 billion is lost on financial sector balance sheets, including through reduced collateral of technically insolvent firms, implying an amplification of the loss by 29%. Banks are only moderately exposed. Funds own a much larger share of the risk, confirming previous studies22. Indeed, included in the equity loss is $90 billion owned directly by pension funds, which adds to an unknown but likely substantial portion of pensions invested by asset managers23. Geographically, the US and UK financial sectors display much larger losses than other countries (Fig. 4c). Although we focus on risks from the equity transmission channel, possible further amplification via the debt channel should also be considered. Here, second- and further-round effects may lead to additional sell-offs, and asset price declines4,24,25,26. Our results show that even in the ‘first round’ of the equity ownership, technical insolvencies can add to credit risk by impairing the collateral of highly exposed companies.

Political economy implications

Which stage of loss propagation is of most interest depends on the stakeholder. Local employees in the sector and governments earning oil and gas royalties must worry about stage 1 losses. As we show in Supplementary Figs. 6 and 7, lost revenues that pay workers’ wages and suppliers’ revenue are four times as large on average as the lost profits we calculate. The lost revenue–profit ratio in OECD countries is larger and derives from differences in break-even prices. Despite this, the revenue losses relative to GDP are largest in oil-exporting developing countries (Extended Data Fig. 9)27.

While previous stranded assets studies have focused on producer countries (stage 1)28, our propagation calculation reveals the political economy of stranded assets at the more elusive stage of financial ownership. Stage 2 results show that about half of the assets at risk of stranding are operated by companies headquartered in OECD countries. Decarbonisation efforts by such countries may therefore be more effective in reducing oil and gas supply than stage 1 results would suggest.

Naturally, the present market outlook may incentivize some international oil companies simply to diversify away from oil and gas29, and some companies have recently sold major assets30. Who is buying these assets should interest financial regulators, as should the overall ownership distribution at stage 3. Asset ownership changes are, as such, unlikely to mitigate the systemic risk that regulators seek to mitigate. The assets then simply move to other owners with their own potential to transmit transition risk, leading to ‘ownership leakage’. Our results highlight that it matters which types of owners are holding the risk. In line with previous research, we document a strong exposure of non-bank financial institutions, in particular pension funds, to stranded-asset risk. One key concern for supervisors should be that these are less regulated than banks31, with lower understanding of contagion potential within the financial system22. Supplementary Note 14 compares our estimated US$681 stranded assets potentially on financial institutions’ balance sheets with the mispriced subprime housing assets of an estimated US$250–500 billion on financial sector balance sheets that triggered the 2007–2008 financial crisis.

Stage 4 highlights that ultimately the losses are borne by governments or individual share and fund owners. The latter are likely to lobby governments for support and thereby to shift more stage 4 losses to the government. Investment decisions in oil and gas could already be pricing in potential bailouts32. Comparing stranded assets to GDP ratios (Extended Data Fig. 9) suggests that, as exposed private investments are mostly in wealthy countries, bailouts would be feasible. Compensating the entire loss under a medium realignment would amount to no more than 1–2% of GDP for most rich countries. The highest losses relative to GDP occur in countries where government ownership is significant, including in Norway and Russia. So the largest risks are already on governments’ balance sheets. Lobbying for bailouts may be more intense if influential groups are set to lose wealth33. As an example, in the United States, we estimate that the wealthiest 10% of households hold about 82% of the US stage 4 losses (Supplementary Note 15). This loss would amount to only 0.4% of the wealthiest households’ net worth and would hardly affect the US wealth distribution. Yet, those households most affected might deploy their substantial political influence to lobby for compensation. The moral hazard of investing with a view to being bailed out could thus lead to investments consistent with pre-realignment demand even if certain investors or the oil and gas companies themselves have already realigned their expectations. This in turn could lead other, less forward-looking investors not to realign their expectations, making it easy to obtain financing for additional, ultimately unprofitable exploration and drilling, and delaying expectations realignment.

Financial geography of stranded assets

It is well documented that the overwhelming majority of unused oil and gas reserves are in the Middle East34, and that local state-owned companies own most global reserves35. Our results show that equity investors from mostly OECD countries are currently exposed to much more of global fossil-fuel stranded assets risk than the geographical view implies. Irrespective of which expectations realignment we apply, more than 15% of all stranded assets are transferred from countries in which physical assets lose their value to OECD country investors. This configuration suggests two conclusions about the energy transition.

First, financial investors and ultimate owners in OECD countries benefit from more profits on oil and gas than domestic production volumes suggest. As a result, there is a potentially perverse incentive in the financial sector of these countries to accept inertia or even slow the low-carbon transition and earn dividends from the continued operation of fossil-fuel production36. Even if unsuccessful, financial investors may lobby for bailouts from governments. OECD countries have the financial means to provide these bailouts, which might in turn affect financial investors’ expectations and ultimately investments in oil and gas production, influencing the amount of assets at risk37. Finance is not politically neutral, and which activities get financed ultimately depends on investors’ choices38. On the flipside, if they wish to take genuine action, rich country stakeholders have more leverage about global investments in the sector. In addition to guiding investments through green finance classifications and requirements39,40, policy-makers could work with activist investors to lower capital expenditure of oil and gas companies rather than allowing divestment to turn into ownership leakage.

Second, domestic sectoral exposure can be a weak indicator of financial risks from asset stranding, and international linkages could increase the risk of financial instability. This problem needs attention from modellers and policy-makers. Simply assuming a uniform distribution of risk across a sector in the portfolio can be misleading. In fact, we show for the equity channel that depending on the pattern of expectations realignment, different companies and geographies can have highly variable exposures to stranded asset risk due to cost differentials, international ownership and producer behaviour. Stress tests and scenario exercises may therefore benefit from variable risk distributions within, not just across, sectors. Even if outright financial instability is avoided, the large exposure of pension funds remains a major concern. In all circumstances, the political implications of loss allocations at each stage are likely to be major. International cooperation on managing and financing the production and stable phase-out of fossil fuels is needed to lessen destabilizing expectation realignments and their social repercussions.

Methods

Global energy demand

To generate global oil and gas demand and price time series for each scenario, we use the IAM E3ME-FTT-GENIE13,14 framework based on observed technology evolution dynamics and behaviour measured in economic and technology time series. It covers global macroeconomic dynamics (E3ME), S-shaped energy technological change dynamics (FTT)15,16,17, fossil-fuel and renewable-energy markets41,42, and the carbon cycle and climate system (GENIE)18. We project economic change, energy demand, energy prices and regional energy production. Global energy demand is only weakly dependent upon the choice of IAM (Supplementary Note 10 and Supplementary Figs. 10–13).

The E3ME-FTT-GENIE integrated framework is described in Supplementary Note 1. The full set of equations underpinning the framework is given and explained in Mercure et al.13. Assumptions for all scenarios are described in Supplementary Note 2.

Energy supply

The allocation of oil and gas production, revenues and income is estimated by integrating data from the Rystad Ucube43 dataset in the form of break-even cost distributions at the asset level into E3ME-FTT-GENIE’s energy market model. The Rystad dataset documents 43,439 oil and gas existing and potential production sites worldwide covering most of the current global production and existing reserves and resources. It provides each site’s break-even oil and gas prices, reserves, resources and production rates. We use this information with the exception of Rystad’s projected rates of asset production and depletion44. Instead, our projections are based on E3ME-FTT-GENIE’s energy market model, derived from a dynamic fossil-fuel resource-depletion model13 that does not rely on Rystad assumptions.

The energy market model assumes that each site has a likelihood of being in a producing mode that is functionally dependent on the difference between the prevailing marginal cost of production and its own breakeven cost. The marginal cost is determined by searching, iteratively with the whole of E3ME, for the value at which the supply matches the E3ME demand, which is itself dependent on energy carrier prices. Dynamic changes in marginal costs are interpreted as driving dynamic changes in energy commodity prices.

The Rystad dataset includes information about each asset’s location (country of production), the owners of the asset (among 3,113 fossil-fuel companies) and the country of the owners’ headquarters. For each asset, annual levels of oil and gas production, revenue and income are estimated per scenario and aggregated at country of production or firm headquarters country. We estimate stranded assets by comparing expected discounted profit streams under a realignment from a baseline to policy scenario at a high level of disaggregation (asset-level). Then, by aggregating the losses at the firm and country level, we can study the loss propagation from the asset level to the fossil-fuel companies, and from the country of production to the headquarters countries (see detail in section Asset-specific and aggregated stranding).

The regional production levels are based on production to reserve ratios, which are exogenous parameters representing producer decisions. Initial values are obtained from the data to reproduce current regional production according to the reserve and resources database. Future changes in production to reserve ratios for each region are determined according to chosen rules for the quota and sell-off scenarios. Changes are only imposed on production to reserve ratios of OPEC countries, to either achieve a production quota that is proportional to global output (quota scenario, thereby reducing production to reserve ratios accordingly), or to attempt to maintain constant absolute production while global demand is peaking and declining (sell-off scenario, thereby increasing production to reserve ratios). While oil and gas output in OPEC are thus altered by these parameter changes representing producer decisions, this change affects the allocation of production globally so as to match global demand.

Renewables are limited through resource costs by technical potentials determined in earlier work41.

We supplement the Rystad assets with additional oil and gas resources data used in earlier versions of E3ME that are based on national geological surveys and tapped as Rystad reserves decline in the future. This hardly affects our 15 yr horizon but where such resources are tapped, the asset is split among companies active in the asset’s country in 2019 according to their 2019 share in national reserves. We apply the same method of ownership allocation to Open Acreage assets in Rystad.

Company ownership

The company financial and ownership data are from Bureau van Dijk’s ORBIS database. They were downloaded in January 2020, typically reporting financial data from 2019 and, where not yet available, from 2018. It is neither feasible nor desirable to download the entire database: 300 million companies, with the download interface allowing about 100,000 companies per download (the exact number depends on the number of variables selected) and most companies small with missing financial and ownership data, and therefore separate from an ownership network. Instead, the download protocol relies on downloading first important (large) companies and then using a snowballing method to capture other companies that are reported as owners of these large companies but were not downloaded. In the first step, data for every company labelled ‘large’ or ‘very large’ were downloaded, as well as the 1,759 companies that were matched with Rystad oil and gas companies. Large and very large companies include all companies that have one of operating revenue >US$13 million, total assets >US$26 million, employees >149 or a stock market listing. Subsequently, via the snowballing method, all companies were downloaded that were listed as shareholders but were not yet downloaded. This iterative procedure was performed six times. Ultimately, the download resulted in 1,772,899 companies (including subsidiaries and their parents) connected by 3,196,429 equity ownership links, with a residual 12,876 unidentified owners. Most ownership links connect companies; however, per country there is one node for individuals and a handful of other summary nodes reflecting partially missing information (for example, unknown investors that are known to be pension funds), thereby summarizing a much larger number of nodes into one for every country. A concordance of types of companies, shareholders and types of financial firms with ORBIS indicators is provided in Supplementary Table 2. Further discussion of limitations of the data is provided in Supplementary Note 5.

Matching Rystad with ORBIS data was done manually due to widely varying spelling conventions. Many companies in Rystad were abbreviated, for example, NNPC, which is the Nigerian National Petroleum Corporation in ORBIS. In total, 1,759 Rystad companies could be matched unambiguously, accounting for 93.4% of the total discounted profit loss calculated in Rystad for the medium realignment.

Equity links occasionally summed to more than 100% of company ownership, most likely because the ORBIS dataset does not relate to a specific snapshot in time. When this happened, ownership fractions were scaled proportionately to sum to 100%. When ownership links summed to less than 100% ownership, the residual ownership would remain in the company as ultimate corporate shareholder (stage 3) and assigned on a country-by-country basis to an ‘unknown’ owner node in stage 4 or a ‘government’ node if the company is a state-owned company.

Imputation of missing company data

Roughly 1.3 million of the 1.77 million companies in the network have some missing balance-sheet data. For the network analysis, for all companies we need to know the equity E to determine insolvencies and the total assets A to derive leverage. We estimate missing data from statistical models that are built from the 460,000 companies that have all data for equity E, total assets A, revenue R, number of employees W and size S.

Equity and total assets are the best predictors of each other (correlation of log-transformed variables, 0.90). Therefore, if only one of these data is missing for a company, we estimate it from the other. If neither is present, we use revenue R to estimate assets A (correlation of log-transformed variables, 0.71) and use the estimated A to estimate equity E. If none of these data are present, we estimate A (and then E) from the number of employees W (correlation of log-transformed variables, 0.45). Linear regressions of natural log-transformed variables are used for these estimates, that is

where v1 is the dependent variable, v2 is the predictor, and a and b are fitting constants. We apply these regressions stochastically to avoid artificially reducing the variance of the equity distribution, calculating the mean prediction from the regression relationship, and then adjusting the estimate by drawing randomly from the residual standard error. When applying the regressions, we enforce the inequality A ≥ E, by simply applying E = min(A,E). The regression coefficients and standard errors are tabulated in Supplementary Table 3.

All of these four data are missing for ∼340,000 companies, and for these we estimate total assets using the categorical variable size S (large, medium, small, very large). For these companies, we do not use regression, but instead draw A randomly from a normal distribution of the log-transformed data which depends upon size. Randomly drawn assets less than $100,000 are assigned a value of $100,000. We then estimate equity from the regression against A (Supplementary Table 4), again enforcing the inequality A ≥ E by applying E = min(A,E).

The imputation code is available at ref. 45.

Asset-specific and aggregated stranding

We define an asset, indexed by k in 1,…, K, as the present value of a sequence of a share of profits from a particular oil or gas field, accruing to an oil or gas company that owns that share including via service- and revenue-sharing contracts46. There are 43,439 unique oil and gas fields with non-zero reserves, and these are partitioned into K = 69,990 ownership shares and hence assets. Oil and gas fields have a production profile at each time t (measured in years) for scenarios a, b. Revenue at asset k at time t in scenario a is defined as the price of oil or gas, pt,a, multiplied by the output, qk,t,a, from the oil or gas field accruing to the owner of k. Profits are estimated in the same way, by subtracting asset-level costs, ck(qk,t,a), which are a function of the quantity produced, from revenue. Thus, we calculate the net present value (NPV) of asset-level profit losses, which we call asset stranding, Ak (a positive number is a profit loss and so stranding is positive), that occurs by an expectations realignment, from baseline, a, to policy scenario, b, as

where r is the discount rate, which we set to 6%, t0 = 2022 is the time of change of expectations and T = 14 years the horizon over which we assume companies to include future expected profits in their balance sheet.

These stranded assets are then aggregated. Thus, we calculate the NPV of asset losses, σ, from expectations realignment for some group, G, of assets, from baseline a to policy scenario b as

where G can be defined by company ownership and/or geography, up to G = {1,…, K} for global asset stranding. To arrive at the loss distribution in stage 1, we partition the set of stranded assets according to their geographic location. To move to further stages, we first partition stranded assets according to their fossil-fuel company ownership. In particular, if the ith fossil-fuel company owns the set of assets Ci, we define the stranded assets of company i as

This distribution of stranded assets across fossil-fuel companies serves as the input for the propagation of ownership risk in our network model.

Network propagation

Stranded assets reduce the value of some assets to zero. When these assets are owned by another entity, the loss propagates to them. We call this propagation a ‘shock’. We have built a network model to propagate the stranded asset shock through to ultimate owners. Our study is focused explicitly on the ownership of fossil-fuel assets and so we consider only the direct effects on equity, neglecting distress to the debt network and the potential for fire sales47.

We have a network comprising N = 1,772,899 companies connected by 3,196,429 equity ownership links. Each link connects an owned company i with one of its owners j, and is defined by the fraction of equity fij of company i owned by company j. The initial shocks from equation (4), which are \(s_i^0 = \sigma _{i,a,b}\) for i = 1,…, N, are distributed across the 1,759 fossil-fuel companies within the network (yielding the loss distribution at stage 2 and propagated through the ownership tree, to get to stage 3).

At each iteration l we work through the owners and their respective ownership links in turn and transmit any shock si in owned company i to its owners, determined by either fij, the fractional holding of company i by company j or \(f_{ij}^m\), the fraction of company i owned by the managed funds of company j. Thus the iteration step for owner j can be expressed as

where mj is the shock to managed funds, which are not propagated further. Note that \(s_j^l\) is the total shock experienced at company j accumulated up to iteration l but only the shock increase at the previous iteration is propagated onwards along the ownership chain at each iteration.

We apply these shocks to a company’s balance sheet. We reduce the asset side by the amount of the shock, and to keep the sheet balanced, we reduce the liability side by subtracting an equal amount of equity. If the shock sj felt by any company exceeds its equity, that company is considered technically insolvent, and any excess shock is not transmitted to the owners of the company. The excess shocks are accumulated to totals for the country and sector of the technically insolvent company (or as a domestic creditor liability in stage 4). Fund managers’ balance sheets are not affected by a shock to their managed funds. We continue looping until convergence, defined to be when the total transmitted shock during an iteration, \(\mathop {\sum }\limits_j \left( {s_j^l - s_j^{l - 1}} \right)\), is less than US$100,000. At convergence, we discontinue the propagation algorithm, and then sum the shocks in all companies to derive the aggregated shock at stage 3.

To derive the accounting summary (which integrates shocks and allocates them by country and sector at stages 3 and 4), we conservatively assume that the complete chain of ownership is consolidated into the ultimate corporate owner, so that no shock is ever counted twice, that is, it is not counted for companies in intermediate steps of the ownership chain. To do so we weight the shock in each company by the fraction of its equity that is not owned by another company in the network. For example, if company A is 30% owned by no other company (either because of lack of ownership data or because it is owned by ultimate owners such as individuals), 30% of the shock to that company will be recorded in the company itself as the ultimate corporate owner, while 70% of the shock will be recorded in the ownership chain. The globally integrated weighted shock is thus calculated as

where \(F_i = \mathop {\sum }\limits_{j = 1}^{N} f_{ij}\) is the fraction of each company that is owned by other companies in the network, noting that this definition means S is identically equal to the input shock \(\mathop {\sum }\limits_{i = 1}^{N} \sigma _i^0\). By summing over subsets of companies, we arrive at the loss distribution at stage 3.

Finally, to allocate losses from ultimate corporate to ultimate owners (Stage 4) we pass on the shock in ultimate corporate owners to governments, shareholders (both via equity and fund ownership), creditors where losses exceed equity on balance sheets, and, where no ultimate owner is given for equity losses, to an ‘unknown’ ultimate owner.

The following should be noted with respect to the data. First, in the raw downloaded network data there were ∼100 ownership loops of two or more companies through which companies own each other (most simply when company A owns company B which owns company A). These are unrealistic data errors which may, for instance, arise from the fact that ORBIS data do not relate to a precise snapshot in time. We searched for these ‘bad links’ by applying a uniform shock to every node in the network and iterating forwards. Ownership loops do not converge but instead amplify a shock to infinity. Using this approach, we identified 391 connections within circular loops, and we bypass these connections during the shock propagation. All other loops converge according to a geometric series with a common ratio below 1.

Second, two alternative sets of imputed data were tested to check the robustness of our results with respect to uncertainty about company equity size driven by stochastic imputation of missing data (see above). The only effect of the size of a company’s equity in the propagation algorithm is to determine whether or not a company is shocked hard enough to make it technically insolvent (at which point the shock stops propagating and is accounted for as a shock to unknown creditors rather than to the company’s owners, see also Supplementary Note 4). The shocks to unknown creditors in the default network agreed to within 5% between two alternative imputed networks (US$402 billion and US$417 billion). These two imputed datasets generated 1,479 and 1,448 insolvencies, respectively, and 1,303 of the insolvent companies were common to both analyses. These comparisons suggest that imputation uncertainties are modest at the highly aggregated level of results we provide, although clearly caution is demanded when interpreting outputs at the company level. Each company is associated with a flag that identifies whether its data have been imputed to aid such interpretation.

Third, to discuss how stock-market-listed companies and financial companies are affected in the main text section ‘Risk of loss amplification in financial markets’, we make one modification to the assumption of complete consolidation of the ownership chain into the ultimate parent company. Specifically, in Fig. 4, we do not integrate weighted shocks (equation (7)), but instead integrate them as the unweighted sum \(\mathop {\sum }\limits_{i = 1}^{N} s_i\). Since stock market indices record listed companies, regardless of where they are located in our order of propagation, this method allows us to calculate the impact of our realignments on the stock market. Similarly, since potentially all financial companies in an ownership chain are affected by the loss, this provides an upper bound to the effect on the financial system. Since some financial companies in the ownership chain may be subsidiaries of others, however, without an independent balance sheet, this complete disaggregation of companies can be seen as an upper bound of the effect on the financial system, while the complete aggregation into an ultimate corporate owner can be seen a lower bound.

The network code is available at ref. 45.

Data availability

Data from Rystad (on energy supply assets) and ORBIS (on company owernship) were accessed under license and cannot be shared. Data are available, however, on reasonable request and with permission from Rystad and ORBIS, respectively, from the authors. Data underlying figures are available at ref. 45. An implementation from 2018 of the E3ME-FTT-GENIE scenarios will be available with the IPCC’s 6th Assessment Report database. Source data are provided with this paper.

Code availability

The code of the network model, for imputing missing financial information and for generating figures, are available at ref. 45. The code that generates the network inputs from the E3ME-FTT-GENIE scenarios and from the company database is available from the authors on reasonable request. The code used by E3ME-FTT-GENIE to generate the underlying scenarios is available from the authors on reasonable request. The model is described in detail in ref. 13.

References

Net Zero by 2050 (International Energy Agency, 2021).

Semieniuk, G., Campiglio, E., Mercure, J.-F., Volz, U. & Edwards, N. R. Low-carbon transition risks for finance. WIREs Clim. Change 12, e678 (2021).

Fisch-Romito, V., Guivarch, C., Creutzig, F., Minx, J. & Callaghan, M. Systematic map of the literature on carbon lock-in induced by long-lived capital. Environ. Res. Lett. 16, 053004 (2021).

Battiston, S., Mandel, A., Monasterolo, I., Schütze, F. & Visentin, G. A climate stress-test of the financial system. Nat. Clim. Change 7, 283–288 (2017).

The Main Results of the 2020 Climate Pilot Exercise. Analysis and Synthesis No. 122 (Banque de France, 2021); https://acpr.banque-france.fr/en/main-results-2020-climate-pilot-exercise

Vermeulen, R. et al. The heat is on: a framework for measuring financial stress under disruptive energy transition scenarios. Ecol. Econ. 190, 107205 (2021).

van der Ploeg, F. & Rezai, A. Stranded assets in the transition to a carbon-free economy. Annu. Rev. Resour. Econ. 12, 281–298 (2020).

Caldecott, B. Introduction to special issue: stranded assets and the environment. J. Sustain. Financ. Invest. 7, 1–13 (2017).

Monasterolo, I. Climate change and the financial system. Annu. Rev. Resour. Econ. 12, 299–320 (2020).

A Call for Action: Climate Change as a Source of Financial Risk (Network for Greening the Financial System, 2019).

Emissions Gap Report 2020 (United Nations Environment Programme, 2020).

Bolton, P., Despres, M., Pereira Da Silva, L. A., Samama, F. & Svartzman, R. The Green Swan: Central Banking and Financial Stability in the Age of Climate Change (Bank for International Settlements, 2020).

Mercure, J.-F. et al. Environmental impact assessment for climate change policy with the simulation-based integrated assessment model E3ME-FTT-GENIE. Energy Strateg. Rev. 20, 195–208 (2018).

Mercure, J. F. et al. Macroeconomic impact of stranded fossil fuel assets. Nat. Clim. Change 8, 588–593 (2018).

Mercure, J. F. et al. The dynamics of technology diffusion and the impacts of climate policy instruments in the decarbonisation of the global electricity sector. Energy Policy 73, 686–700 (2014).

Mercure, J. F., Lam, A., Billington, S. & Pollitt, H. Integrated assessment modelling as a positive science: private passenger road transport policies to meet a climate target well below 2 °C. Climatic Change https://doi.org/10.1007/s10584-018-2262-7 (2018).

Knobloch, F., Pollitt, H., Chewpreecha, U., Daioglou, V. & Mercure, J. F. Simulating the deep decarbonisation of residential heating for limiting global warming to 1.5 °C. Energy Effic. https://doi.org/10.1007/s12053-018-9710-0 (2019).

Holden, P. B., Edwards, N. R., Gerten, D. & Schaphoff, S. A model-based constraint on CO2 fertilisation. Biogeosciences 10, 339–355 (2013).

Fichtner, J. & Heemskerk, E. M. The new permanent universal owners: index funds, patient capital, and the distinction between feeble and forceful stewardship. Econ. Soc. 49, 493–515 (2020).

Alstadsæter, A., Johannesen, N. & Zucman, G. Who owns the wealth in tax havens? Macro evidence and implications for global inequality. J. Public Econ. 162, 89–100 (2018).

NGFS Climate Scenarios for Central Banks and Supervisors (Network for Greening the Financial System, 2021).

Roncoroni, A., Battiston, S., Escobar-Farfán, L. O. L. & Martinez-Jaramillo, S. Climate risk and financial stability in the network of banks and investment funds. J. Financ. Stab. 54, 100870 (2021).

Braun, B. in The American Political Economy: Politics, Markets, and Power (eds Hacker, J. S. et al.) Ch. 9 (Cambridge Univ. Press, 2022).

Mandel, A. et al. Risks on global financial stability induced by climate change: the case of flood risks. Climatic Change 166, 4 (2021).

Elliott, M., Golub, B. & Jackson, M. O. Financial networks and contagion. Am. Econ. Rev. 104, 3115–3153 (2014).

Battiston, S., Puliga, M., Kaushik, R., Tasca, P. & Caldarelli, G. DebtRank: too central to fail? Financial networks, the Fed and systemic risk. Sci. Rep. 2, 1–6 (2012).

Ansari, D. & Holz, F. Between stranded assets and green transformation: fossil-fuel-producing developing countries towards 2055. World Dev. 130, 104947 (2020).

Mercure, J.-F. et al. Reframing incentives for climate policy action. Nat. Energy 6, 1133–1143 (2021).

Jaffe, A. M. Stranded assets and sovereign states. Natl Inst. Econ. Rev. 251, R25–R36 (2020).

Raval, A. A. $140bn asset sale: the investors cashing in on Big Oil’s push to net zero. Financical Times (5 July 2021).

Knight, M. D. The G20’s reform of bank regulation and the changing structure of the global financial system. Glob. Policy 9, 21–33 (2018).

Sen, S. & von Schickfus, M.-T. Climate policy, stranded assets, and investors’ expectations. J. Environ. Econ. Manag. 100, 102277 (2020).

Esteban, J. & Ray, D. Inequality, lobbying, and resource allocation. Am. Econ. Rev. 96, 257–279 (2006).

McGlade, C. & Ekins, P. The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature 517, 187 (2015).

Heede, R. & Oreskes, N. Potential emissions of CO2 and methane from proved reserves of fossil fuels: an alternative analysis. Glob. Environ. Change 36, 12–20 (2016).

Colgan, J. D., Green, J. F. & Hale, T. N. Asset revaluation and the existential politics of climate change. Int. Organ. 75, 586–610 (2021).

Battiston, S., Monasterolo, I., Riahi, K. & van Ruijven, B. J. Accounting for finance is key for climate mitigation pathways. Sci. (80-.). 372, 918 LP–918920 (2021).

Mazzucato, M. & Semieniuk, G. Financing renewable energy: who is financing what and why it matters. Technol. Forecast. Soc. Change 127, 8–22 (2018).

Smoleńska, A. & van ‘t Klooster, J. A risky bet: climate change and the EU’s microprudential framework for banks. J. Financ. Regul. 8, 51–74 (2022).

Dafermos, Y. & Nikolaidi, M. How can green differentiated capital requirements affect climate risks? A dynamic macrofinancial analysis. J. Financ. Stab. 54, 100871 (2021).

Mercure, J.-F. & Salas, P. On the global economic potentials and marginal costs of non-renewable resources and the price of energy commodities. Energy Policy 63, 469–483 (2013).

Mercure, J.-F. & Salas, P. An assessement of global energy resource economic potentials. Energy 46, 322–336 (2012).

Rystad Ucube Database (Rystad Energy, 2020).

BEIS Fossil Fuel Supply Curves (Rystad Energy, 2019).

Semieniuk, G. et al. Figure data and model used in ‘Stranded fossil-fuel assets translate to major losses for investors in advanced economies’. Zenodo https://doi.org/10.5281/zenodo.6347122 (2022).

Ghandi, A. & Lin, C. Y. C. Oil and gas service contracts around the world: a review. Energy Strateg. Rev. 3, 63–71 (2014).

Battiston, S., Caldarelli, G., D’Errico, M. & Gurciullo, S. Leveraging the network: a stress-test framework based on DebtRank. Stat. Risk Model. 33, 117–138 (2016).

Acknowledgements

We thank N. Seega at CISL for critical support in effectively engaging stakeholders, A. Cantrell, J. Garcia-Bernardo, D. Hawkins, M. Rehm, F. Takes, I. Weber, K. Young, colleagues at ORTEC, participants at two stakeholder workshops and the 25th FMM Conference for insightful discussions, and A. Cantrell, Y. Dafermos, E. Schets, R. Svartzman and J. van ‘t Klooster for feedback on earlier drafts. G.S., P.B.H., J.-F.M., P.S., H.P., N.R.E. and J.E.V. acknowledge funding from the Natural Environment Research Council grant NE/S017119/1, P.B.H. and N.R.E. from the Leverhulme Research Centre Award (RC-2015-029) from the Leverhulme Trust, and P.S. from the Prince of Wales Global Sustainability Fellowship supported by Paul and Michelle Gilding.

Author information

Authors and Affiliations

Contributions

G.S., P.B.H., J.-F.M., P.S., H.P., N.R.E and J.E.V. designed and conceptualized the research. J.-F.M., H.P., P.V., U.C. and P.B.H contributed to and ran the E3ME-FTT-GENIE simulations to generate energy demand and supply, P.S. integrated the Rystad database and with contributions from P.B.H., G.S. and J.-F.M. calculated initial shock distributions from realignments. G.S. curated the ownership network database with contributions from K.J. P.B.H. designed the network model and ran the realignment scenarios with contributions from G.S., J.-F.M, P.S. and N.R.E. G.S. wrote the article with contributions from N.R.E., P.B.H., J.E.V., J.-F.M., H.P. and P.S. G.S. coordinated the research with contributions from P.B.H, J.-F.M. and N.R.E., and N.R.E. coordinated the overall FRANTIC grant project.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Climate Change thanks Matthew Binsted, Julie Rozenberg and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Extended data

Extended Data Fig. 1 Ownership chain of stranded assets by OECD/non-OECD geography and major institutional categories for various realignments.

a, Benign (TDT_EUEA-SO), b, Severe (InvE_NetZero-SO), c, Medium-Quota (InvE_EUEA-QU), d, Medium (InvE_EUEA-SO) without CCS, e, Medium without network imputations, f, Medium for reference.

Extended Data Fig. 2 Sensitivity to different expectations realignments.

a, major loss categories at Stage 4 under four realignments; b, proportional change in major headquarter country losses at Stage 2 compared to Medium realignment in 3 alternative realignments. Domain truncated at plus and minus 100%. Larger values indicated with arrows. Values below −100% imply gain relative to baseline.

Extended Data Fig. 3 Country ranking at stage 4 of losses across realignments.

All 210 countries are ranked for each realignment in ascending order of their losses at Stage 4. Individual country ranks are connected by a line. Highlighted countries show ‘typical’ cases of Norway with little rank change, low-cost OPEC countries (Kuwait and Saudi Arabia), a tax haven (British Virgin Island) affected by the imputation and a financial centre hit entirely after Stage 1 (Belgium).

Extended Data Fig. 4 Detailed ownership chain of stranded assets under Benign (TDT_EUEA-Selloff) realignment.

Lost profits allocated to a, the country where stranded oil and gas fields lie (Stage 1); b, fossil-fuel company headquarter country (Stage 2); c, ultimate corporate owners by country by sector (Stage 3); d, ultimate owners by country and institutional affiliation (Stage 4). Countries displayed in descending order of Stage 4 losses. Markers indicate loss for Medium (InvE-EUEA-SO) realignment at the respective stage.

Extended Data Fig. 5 Detailed ownership chain of stranded assets under Severe (InvE_NetZero-SO) realignment.

Lost profits allocated to a, the country where stranded oil and gas fields lie (Stage 1); b, fossil-fuel company headquarter country (Stage 2); c, ultimate corporate owners by country by sector (Stage 3); d, ultimate owners by country and institutional affiliation (Stage 4). Countries displayed in descending order of Stage 4 losses. Markers indicate loss for Medium (InvE-EUEA-SO) realignment at the respective stage.

Extended Data Fig. 6 Detailed ownership chain of stranded assets under Medium-Quota (InvE_EUEA-QU) realignment.

Lost profits allocated to a, the country where stranded oil and gas fields lie (Stage 1); b, fossil-fuel company headquarter country (Stage 2); c, ultimate corporate owners by country by sector (Stage 3); d, ultimate owners by country and institutional affiliation (Stage 4). Countries displayed in descending order of Stage 4 losses. Markers indicate loss for Medium (InvE-EUEA-SO) realignment at the respective stage.

Extended Data Fig. 7 Detailed ownership chain of stranded assets without availability of CCS under Medium (InvE_EUEA-SO) realignment.

Lost profits allocated to a, the country where stranded oil and gas fields lie (Stage 1); b, fossil-fuel company headquarter country (Stage 2); c, ultimate corporate owners by country by sector (Stage 3); d, ultimate owners by country and institutional affiliation (Stage 4). Countries displayed in descending order of Stage 4 losses. Markers indicate loss for Medium (InvE-EUEA-SO) realignment at the respective stage.

Extended Data Fig. 8 Detailed ownership chain of stranded assets without network imputations under Medium (InvE_EUEA-SO) realignment.

Lost profits allocated to a, the country where stranded oil and gas fields lie (Stage 1); b, fossil-fuel company headquarter country (Stage 2); c, ultimate corporate owners by country by sector (Stage 3); d, ultimate owners by country and institutional affiliation (Stage 4). Countries displayed in descending order of Stage 4 losses. Markers indicate loss for Medium (InvE-EUEA-SO) realignment at the respective stage.

Extended Data Fig. 9 Loss as a share of GDP for major countries under Medium realignment.

Lost profits divided by 2019 GDP at market exchange rates allocated to a, the country where stranded oil and gas fields lie (Stage 1); b, fossil-fuel company headquarter country (Stage 2); c, ultimate corporate owners by country by sector (Stage 3); d, ultimate owners by country and institutional affiliation (Stage 4). Countries displayed in descending order of Stage 4 losses in Fig. 3. Markers indicate country loss totals at previous stages.

Supplementary information

Supplementary Information

Supplementary Notes 1–15, Figs. 1–7, Tables 1–10 and references.

Source data

Source Data Fig. 1

Model simulation source data.

Source Data Fig. 2

Model simulation source data.

Source Data Fig. 3

Model simulation source data.

Source Data Fig. 4

Model simulation source data.

Source Data Extended Data Fig. 1

Model simulation source data.

Source Data Extended Data Fig. 2

Model simulation source data.

Source Data Extended Data Fig. 3

Model simulation source data.

Source Data Extended Data Fig. 4

Model simulation source data.

Source Data Extended Data Fig. 5

Model simulation source data.

Source Data Extended Data Fig. 6

Model simulation source data.

Source Data Extended Data Fig. 7

Model simulation source data.

Source Data Extended Data Fig. 8

Model simulation source data.

Source Data Extended Data Fig. 9

Model simulation source data.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Semieniuk, G., Holden, P.B., Mercure, JF. et al. Stranded fossil-fuel assets translate to major losses for investors in advanced economies. Nat. Clim. Chang. 12, 532–538 (2022). https://doi.org/10.1038/s41558-022-01356-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41558-022-01356-y

This article is cited by

-

Inequality repercussions of financing negative emissions

Nature Climate Change (2024)

-

Model-based financial regulation challenges for the net-zero transition

Nature Climate Change (2024)

-

The role of the IPCC in assessing actionable evidence for climate policymaking

npj Climate Action (2024)

-

Model-based financial regulations impair the transition to net-zero carbon emissions

Nature Climate Change (2024)

-

Supply-side climate policy and fossil fuels in developing countries: a neo-Gramscian perspective

International Environmental Agreements: Politics, Law and Economics (2024)